Marc Andreessen’s Secret Weapon for Finding Startup Investments

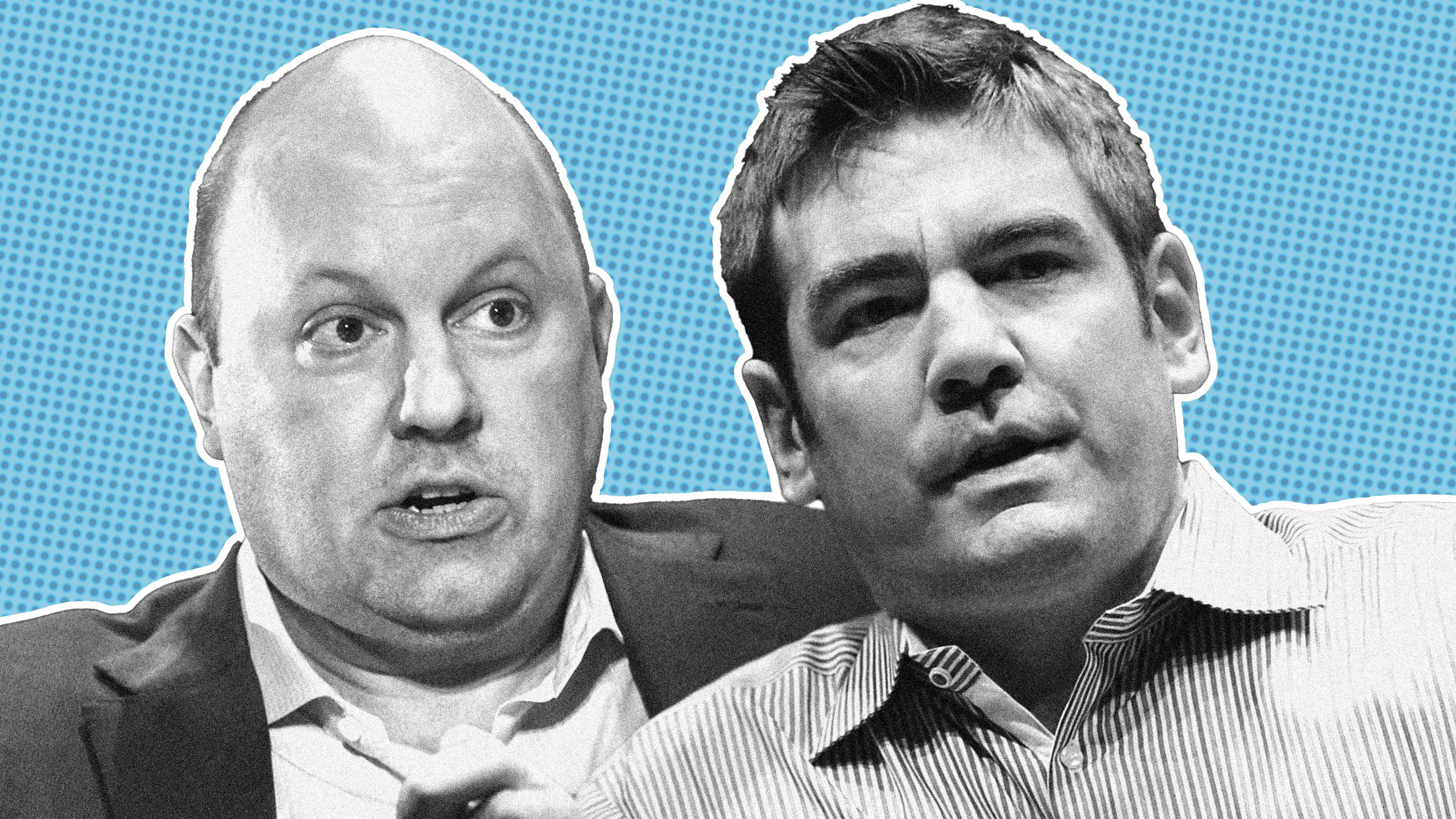

The Andreessen Horowitz co-founder became a top tech venture capitalist with his savvy bets on startups. Now Andreessen and another partner at the firm, Chris Dixon, are seeking to stay ahead in the hypercompetitive world of early-stage investing by putting their personal money into microfunds.

When Lucy Guo pitched Andreessen Horowitz in 2016 on an early funding round for her company, an artificial intelligence startup called Scale, the high-powered venture capital firm passed on the deal.

In 2019, Guo sent a cold email to Chris Dixon, a general partner at the firm, asking again for capital, this time for a tiny VC fund she was raising alongside tech entrepreneur Dave Fontenot. Dixon agreed and lassoed his investment partner Marc Andreessen to co-write a $100,000 check from their personal funds for Guo’s Backend Capital, which has raised a total of $7 million.

The Takeaway

Powered by Deep Research

Startup investors like Guo—who are often referred to as superangels—have been around for years, and their microfunds have become a widely recognized part of the funding ecosystem in Silicon Valley. What’s less well known is the increasingly significant role that established venture capitalists at firms like Andreessen Horowitz are playing in providing financing to them.

Partners in those venture firms generally aren’t looking to make big profits directly from the money they put into microfunds. Instead, they are investing in a new generation of deal-makers and hypernetworkers who can provide insight into innovative young startups—and possibly reserving more lucrative opportunities for their venture firms to invest in the companies later. Forging relationships with promising enterprises still in the cradle has become especially critical for venture firms as competition in early-stage investing reaches a fever pitch.

“It’s an excellent strategy if you’ve got the money to do it,” said Jeffrey Sohl, director of the Center for Venture Research, an organization at the University of New Hampshire that originally coined the term angel investing. “Someone like Marc Andreessen is just sprinkling a bunch of money around. I don’t think he cares whether he makes money, but he can cherry-pick deals.”

In addition to Guo’s Backend Capital, the microfunds Andreessen and Dixon have put money into include Work Life Ventures, a $5 million fund founded by former Zendesk employee Brianne Kimmel; Shrug Capital, founded by former AngelList marketing chief Niv Dror; and an unnamed $1.5 million fund operated by serial entrepreneur Ryan Delk. Andreessen and Dixon wrote Delk a $100,000 check for his fund and Kimmel a $250,000 for her fund, according to people familiar with the matter.

A spokesperson for Andreessen Horowitz declined to comment for this story.

Venture firms and superangels have settled into a mostly symbiotic relationship. Online services like AngelList have led to a proliferation of microfunds by making it easier to track the performance of investment portfolios and to manage connections with limited partners—the people and institutions who supply them with capital.

The result is a growing crowd of less experienced managers seeking counsel and credibility from old-timers at venture firms. The microfund managers can exploit their connections to well-known venture capitalists to attract startups and additional limited partners. While some have been secretive about those connections in the past, many today openly boast of their relationships with icons like Andreessen.

Most venture capitalists, though, have been less talkative about their investments in microfunds. The stakes they acquire in startups could pose conflicts of interest for them, depending on how open they are about those deals with other business partners and entrepreneurs.

VCs, for their part, don’t view superangels as rivals, even though many of the smaller investors aspire to become bigger players in VC themselves. They simply lack the capital necessary to compete with experienced investors.

“There’s a new wave of, let’s call them, Superangels 2.0, and they’re not a threat [to big investors],” said Mike Maples Jr., a founding partner of venture firm Floodgate.

Buying Insight

As a duo, Andreessen and Dixon typically write checks ranging between $100,000 and $1 million at a time for microfunds such as Guo’s, making the investments through a limited liability corporation that is legally separate from Andreessen Horowitz and is capitalized with their personal money.

It is possible that Andreessen Horowitz as a firm also invests in some microfunds, as do other firms like Sequoia Capital and Kleiner Perkins. Standard agreements between limited partners and venture firms allow investment of 20% of funds in “non-venture qualifying opportunities,” including real estate, cryptocurrencies and other funds. Initialized Capital’s Alexis Ohanian and Lowercase Capital founder Chris Sacca—himself an early superangel who hit it big with investments in Uber and Twitter—have invested in microfunds too.

In some cases, venture firms raise dedicated funds to invest in other funds. A prime example is Bain Capital Ventures, which has an effort called the Network Investing Program designed to provide financial support to emerging general partners of small funds. Since the inception of the program, Bain has invested in 48 emerging fund managers, a spokesperson for BCV said.

Andreessen and Dixon have invested in microfunds founded by entrepreneurs they already know from past investments. One of them is Ryan Hoover, founder of the product discovery site Product Hunt, which Andreessen Horowitz invested in in 2014. Andreessen and Dixon have invested a combined $1 million into a second microfund raised by Hoover, who calls his investment vehicle Weekend Fund, according to a source with direct knowledge of the matter.

In total, Hoover has raised $10 million for the second fund through contributions from 120 limited partners. Weekend Fund’s past investments include Girlboss, the online professional network for women; LTSE, the new securities exchange; and others.

‘Someone like Marc Andreessen is just sprinkling a bunch of money around. I don’t think he cares whether he makes money, but he can cherry-pick deals.’

The relationship with Hoover helped connect Andreessen Horowitz to Tandem, a business collaboration startup. Months earlier, Hoover got to know the company’s founders when he helped them prepare for admittance into the Silicon Valley startup accelerator Y Combinator.

“Marc Andreessen knew that I had a connection with them,” Hoover said in an interview. “And they spoke with me to get my perspective on the company and more of a warm mention.”

Last year, Andreessen Horowitz led a $7.5 million seed investment in Tandem, valuing the business at more than $30 million. Weekend Fund invested in the company in the same round.

“I think at the end of the day people are seeking an edge,” said Peter Hébert, a co-founder and managing partner of Lux Capital, a VC firm focused on science and technology. “Just like in the public market, people are seeking to use information to their benefit.”

For Andreessen and Dixon, the new method of scouting out deals is yet another attempt to stay ahead of the competition in the cutthroat venture business. Andreessen co-founded his firm in 2009 with Ben Horowitz, with whom he had worked at Netscape Communications, the early web browser maker. The two entered the venture business with grand ambitions of reshaping startup investing.

With a $300 million debut fund, the two men treated founders like rock stars and hired a large staff to support them with recruiting, marketing efforts and other services. The firm’s first fund was a blockbuster success, in part because of a savvy investment in the internet telephone company Skype. Subsequent funds have produced less spectacular returns, though, as The Information has previously reported.

Dixon became a fixture of the firm in 2012, when he joined from eBay. He is best known for spearheading the firm’s investments in cryptocurrencies by co-leading Andreessen Horowitz’s first-ever crypto-focused fund alongside another partner, Katie Haun. Last year, Forbes reported that Andreessen was “blowing up the venture capital model” once again by registering his firm as a financial advisor so they could go deeper into crypto investing and trading of public stocks.

Small Bets, Small Returns

Whether any of the up-and-coming microfunds will pass the test of time by becoming the next big venture firm comes down to whether these managers make smart investments that lead to meaningful returns, explains Maples of Floodgate. While $25,000 checks seem like a lot of money to most people, these investments don’t generate big payouts by the standards of tech investing.

Even investors who have formed microfunds say the vast majority of them will flop. Sriram Krishnan is currently a senior vice president of product at software maker HeadSpin and the sole general partner of a $3.6 million fund called Kearny Jackson, which is backed by Sequoia, Kleiner Perkins and Bain Capital Ventures, according to a source with direct knowledge of the matter.

“There’s an arms race even within the institutional VC community to go out and find the microfunds to back,“ said Krishnan. “But just like how 99% of startups fail, a lot of these funds will fail.”

Some microfunds are developing specializations that turn them into more than just checkbooks for entrepreneurs. Bobby Goodlatte, a former Facebook product designer who is raising up to $25 million for a microfund called Form Capital, said his firm seeks to make itself more valuable to startups by working with them on product design.

“We do 100 hours of design support with every check, and you can point to that and say, ‘Hey, here’s how we helped,’” said Goodlatte, who founded Form Capital with former Facebook product manager Josh Williams. “The existence of firms like ours will drive change across the whole industry.”

Steve Schlafman recently left an established venture firm, Primary Venture Partners, to raise his own $5 million microfund, a move prompted by his desire to be better aligned with the founders he backs, he said. And while some microfund investors have ambitions of getting much bigger, he doesn’t personally want to create another giant venture firm.

“In any market you have incumbents and new entrants,” said Schlafman. “Some of these new microfunds will rise up and be formidable competitors, but I’m not of the mindset where the angels are going to band together and take over venture.”

Kate Clark is a deputy bureau chief at The Information and the author of the twice-weekly column, Dealmaker. She is based in New York and can be found on Twitter at @KateClarkTweets. You can reach her via Signal at +1 (415)-409-9095.