Recent IPOs Yield Huge Equity Grants for Founders

DoorDash CEO Tony Xu. Photo: Bloomberg

DoorDash CEO Tony Xu. Photo: BloombergSquarespace CEO Anthony Casalena already owns more than a third of the website maker, making him a billionaire on paper following the company’s public market debut last week. But like a growing number of tech founders, Casalena is poised to obtain far more equity thanks to a supersize stock grant designed to reward him if the company’s share price shoots up over the next five years.

Stock awards tied to share-price performance have emerged in recent months as a go-to reward for tech founders taking their companies public, even though the founders already stand to benefit enormously from their existing equity stakes. An ebullient market for tech-related public listings is fueling the growth of mammoth awards, say lawyers and compensation experts, some of whom argue that the scale of the grants unnecessarily enriches already wealthy individuals and disproportionately rewards chief executives compared with other shareholders.

The Takeaway

- CEOs of Palantir, DoorDash among those with largest grants

- Critics say founders shouldn’t need stock awards beyond existing stakes

- Trend emerged in wake of Elon Musk’s 2018 compensation package

Powered by Deep Research

The trend toward giving founders large grants stands in sharp contrast to an earlier era of fabled tech initial public offerings, including those of Google, Facebook and Amazon, whose founders weren’t awarded any additional equity for taking their companies public. Each of those companies said in filings at the time that their founders’ existing stakes were sufficient compensation.

Tech companies began granting founder CEOs additional equity awards ahead of public listings in the past few years, but the size of the grants has ballooned lately. At least 10 newly public companies from Airbnb to Wish have bestowed large grants on their founder CEOs in the past year, with company boards of directors often approving the awards just before the firms go public. Typically, founders are given ample awards based on relatively achievable share price goals, along with an additional, harder-to-reach set of targets that would deliver far more shares.

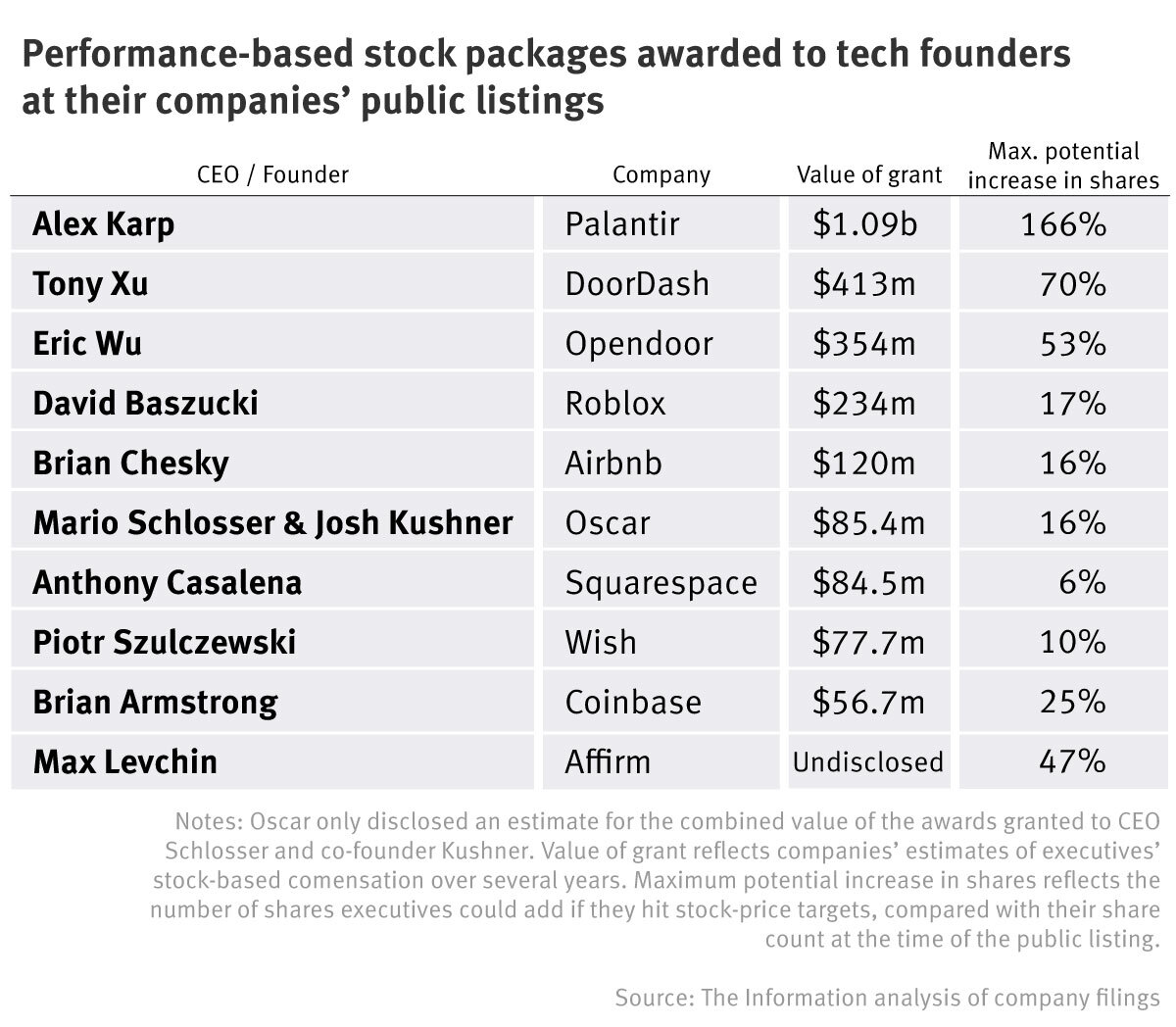

The latest batch of equity awards linked to high-profile public listings could net billions of dollars over the next decade for the founders if the companies hit stock-price milestones. Palantir co-founder Alex Karp and DoorDash co-founder Tony Xu, for example, were awarded two of the largest equity grants, measured by the accounting value of the grants, among more than a dozen companies analyzed by The Information that have gone public recently.

DoorDash granted Xu shares that the company has valued at $413 million, based on the likelihood of hitting certain targets. But Xu will add 70% more shares than he had prior to that—worth nearly $6 billion—if he can help nearly quadruple DoorDash’s stock price over the next seven years. Before receiving the grant, Xu had 14.9 million shares worth $1.5 billion at the IPO price.

Karp would grow his Palantir stake by 166% and add more than $1 billion in equity, after being awarded 141 million stock options that vest over the next decade with an exercise price the company surpassed months after going public. He already had more than 81 million shares worth nearly $600 million at the direct listing reference price.

Squarespace put the value of Casalena’s grant at $84.5 million, given how likely the company is to hit certain stock-price milestones. But the founder would earn an additional $1 billion in stock and grow the number of shares he owns 6% should Squarespace’s share price increase eightfold over the next five years, a more remote target. The company declined to comment.

Critics of the practice say the awards are based on a dubious premise that founders need additional incentives to grow their companies. The result is more wealth for executives who already became rich from their existing stakes in the companies, said Howard Berkower, a partner at law firm McCarter & English who advises companies on public offerings.

He pointed to luminary founders who didn’t get such awards, such as former Amazon CEO Jeff Bezos, who owned about 40% of the company when it went public in 1997. “His shares became worth $150 billion. He didn’t need these additional incentives,” Berkower said.

Not all tech firms that have gone public recently have granted giant stock awards. The founders of software firms Upstart, which went public in December, and Procore, which went public last week, received $8 million and $10 million in equity awards, respectively. Dustin Moskovitz, who became wealthy as a co-founder of Facebook, didn’t receive additional equity awards when his new company, Asana, went public last year, filings show.

The Elon Musk Model

The practice of tying large stock grants to specific long-term targets was inspired in part by Tesla CEO Elon Musk’s 2018 compensation plan, which helped make him one of the world’s wealthiest people.

Other tech executives wanted similar deals. Boards of directors have mostly gone along with it to encourage founders to “hit stretch goals,” said Latham & Watkins partner Tad Freese, who advises tech companies on IPOs. “How do you motivate these founders, who created this incredible thing, to take it to the next level when they already have enough to sit on the beach forever, on their own island?”

Some former executives believe the practice departs too radically from business norms. “When I took my company public, I owned 12% of the shares, maybe a bit more,” said Mark Kvamme, who took tech-focused advertising agency CKS Group public in 1995 and later started VC firm Drive Capital. “I felt my reward was in those shares. I didn’t deserve anything more.”

“In this age of outsized discrepancy between haves and have-nots, this is a brazen idea,” Berkower said. “People are thinking of new ways to get more and more money, even if they can’t spend the money they already have.”

In-Demand CEOs

Many U.S. companies justify big pay packages to their CEOs on the grounds that the executives will in turn deliver large share price gains to their investors. Tech CEOs merit the hefty grants, some entrepreneurs say, because they often have plenty of opportunities to leave the companies they founded for other pursuits after taking them public. It is also a way for founders who raised large sums of venture capital in the private markets to retake more ownership of their companies once they have gone public.

Compensation for successful founders “must be sufficient to pay them not to do anything else,” said Dan Teran, a former WeWork executive who founded office management startup Managed by Q.

In his view, though, the pay packages are inappropriate for companies that are also underpaying front-line workers. The compensation for DoorDash’s Xu was “hard to reconcile,” Teran said, with how poorly the company compensates food-delivery independent contractors.

A DoorDash spokesperson said the company was still young and structured Xu’s compensation to encourage him to hit longer-term goals: “Building the next phase will be as challenging as creating what we have thus far,” the spokesperson said in a statement.

New Formula

While prominent tech CEOs have been awarded large pre-IPO equity grants in the past, the grants weren’t typically tied to stock performance. That was the case in 2019, when Pinterest CEO Ben Silbermann was awarded a new equity grant in conjunction with a public offering that was set to vest over time. Pinterest estimated that the pay package would be worth $46 million by the end of the vesting period.

In contrast, DoorDash’s Xu, Airbnb CEO Brian Chesky, Opendoor CEO Eric Wu and Roblox CEO David Baszucki were awarded new compensation deals last year based on share price performance that their companies estimated to be worth hundreds of millions of dollars. Companies assess the value of the pay packages based on accounting models that determine how likely it is that the businesses will reach those stock-price milestones.

Airbnb estimated the value of Chesky’s package at $120 million, based on the likelihood that the share price will reach certain targets. But the equity package would be worth nearly $6 billion if the share price more than triples over the next decade, a much higher hurdle. (Airbnb said in a securities filing that Chesky “intends to donate the net proceeds from this award to community, philanthropic and charitable causes.”) He already had 74 million shares worth more than $5 billion at the IPO price.

Opendoor said in a filing last month that co-founder Wu received an equity package last year worth more than $350 million, which would increase his current number of shares by more than half, assuming the company hits stock-price targets over the next seven years. Opendoor merged with a special purpose acquisition company last December, making Wu’s existing stake worth nearly $500 million at the current stock price.

Executives don’t always reach their goals. Dropbox CEO Drew Houston was awarded a performance-based pay package that the company valued at more than $100 million in conjunction with its 2018 IPO. The company’s stock price has long been below the first hurdle Houston had to reach to vest more equity.

Other high-profile founders, notably Snap CEO Evan Spiegel, were awarded additional equity that vested as soon as the company went public in 2017. His package was worth more than $600 million without requiring him to hit any time- or performance-based goals.

Cory Weinberg is deputy bureau chief responsible for finance coverage at The Information. He covers the business of AI, defense and space, and is based in Los Angeles. He has an MBA from Columbia Business School. He can be found on X @coryweinberg. You can reach him on Signal at +1 (561) 818 3915.