Why Bitcoin’s Price is Plummeting, How Ransomware Attacks Could Drive Regulation

With Bitcoin prices falling 5% on Tuesday to a little below $33,000, you might think issues dogging crypto—environmental concerns, ransomware and China’s crackdown—have finally caught up with it.

“Over the last two months, there really has been a disproportionate amount of bad news,” said David Nage, a managing director at Arca, a digital asset management firm. Indeed, bitcoin is down 50% since its highs in mid-April—while still double where it was as recently as early December. But the bears shouldn’t celebrate.

Amid the gloom, we got news that Daniel Loeb’s Third Point Management is leading a new funding round for startup BlockFi, a wealth management and trading firm for crypto holders. Investors are discussing putting several hundred million dollars into BlockFi at a valuation close to $5 billion—70% above where it was valued at in March.

We hear that BlockFi is just one of a number of crypto startups seeing enthusiastic interest from investors in the last couple of months, since Coinbase went public at a price that implied massive returns for its early investors. Ironically, of course, Coinbase stock has dropped 40% from its opening trade (it fell nearly 5% today). But for the early investors, even the current price would be a big return. As always, it depends on when you bought in.

CRYPTO’S RANSOMWARE PROBLEM

Some of the selling in bitcoin today can be traced to repercussions flowing from the recent spate of ransomware attacks, demanding cryptocurrency as payment.

For one thing, there’s been so many attacks—including the high profile ones against Colonial Pipeline and JBS meat processor—that stronger regulation seems likely. “I’d be surprised if we don't see some action in response to this,” said Jerry Brito, executive director of policy nonprofit Coin Center.

While he said an all-out ban is unlikely, tighter rules on regulated exchanges could be possible, such as requiring them to provide cash transaction reports. This kind of change would be more of a muscle flex and wouldn’t do much to foil ransomware criminals who rely on rogue, unregulated and foreign exchanges, according to Brito. Still, the Biden administration has to be seen to be doing something.

What is likely to be hurting prices even more is that the U.S. is getting better at catching these cybercriminals. The Justice Department successfully recovered $2.3 million out of the $4.4 million bitcoin ransom Colonial Pipeline paid to Eastern European hacker group DarkSide.

That brings up questions about the security of digital currencies. The FBI was able to somehow obtain the private key that allowed them to access a wallet with the ransom payment and move the money out. The big mystery now is how they were able to get that key in the first place.

Corey Miller, senior growth associate at crypto exchange dYdX, argues it’s unlikely the U.S. government was somehow able to break bitcoin’s security model.

“The more likely scenario is that the hackers sent BTC to an exchange or server located in the U.S. and the government was able to seize the keys via a warrant,” he said.

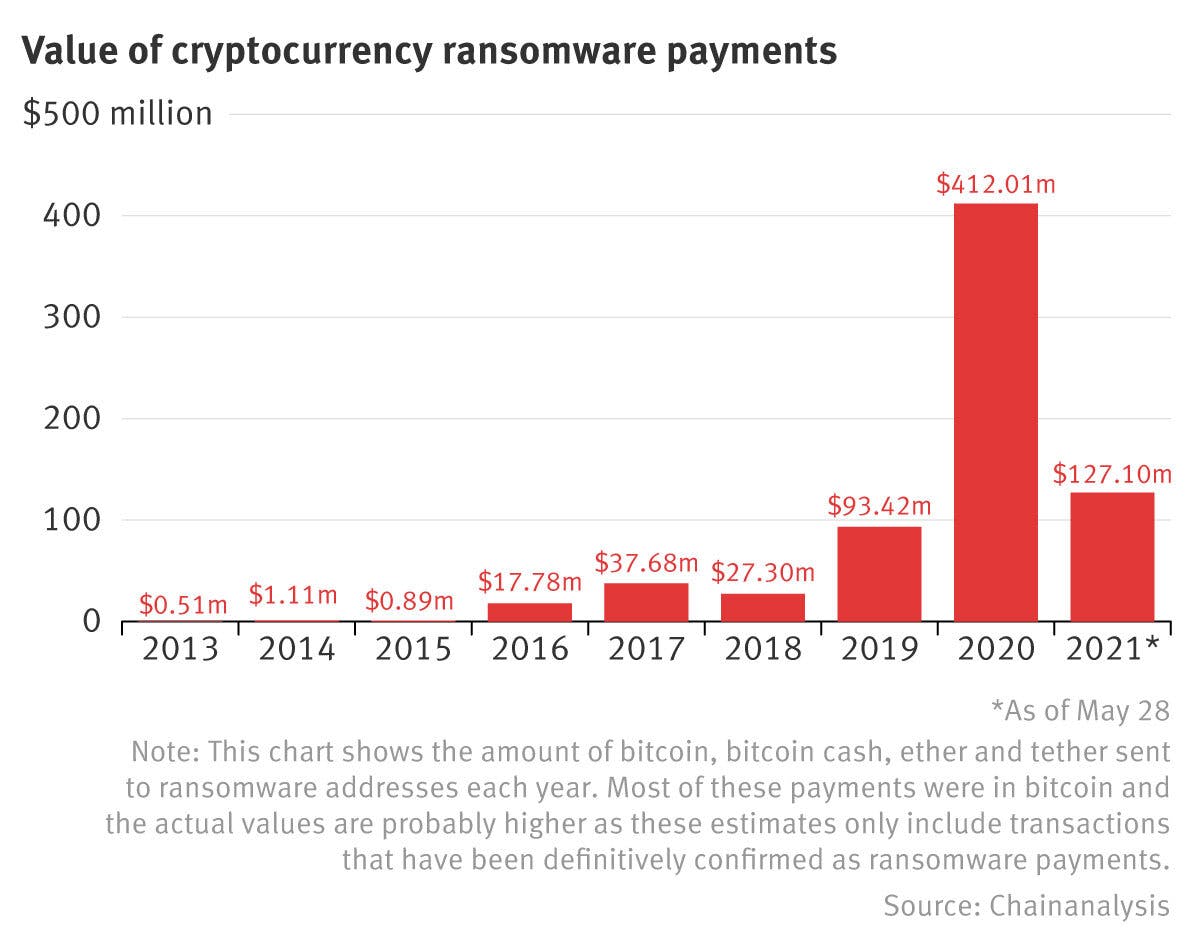

With this in mind, we looked at how much the use of crypto in cyber attacks has changed over time. Between 2019 and 2020, the value of crypto ransom payments grew 341%, according to data from Chainanalysis. Here’s a chart:

BLOCKCHAIN UP AND COMER

Anchorage

Based in: San Francisco

Investors: Visa, Andreessen Horowitz, Blockchain Capital, GIC, Lux and Indico

Funds Raised: $137 million

What Sets It Apart: Founded in 2017, Anchorage became the first federally chartered crypto bank after receiving approval from the U.S. Office of the Comptroller of the Currency in January.

The company, which counts crypto custody, trading and financing among its services, was co-founded by Diogo Mónica, who is president of Anchorage. It was inspired by Mónica’s experience at software company Docker, when he was offered a 20% cut if he was able to unlock a $10 million bitcoin wallet that a client had lost the passphrase for. He eventually was able to gain access.

“That was the whole introduction to how incredibly sophisticated investors can actually be not very competent at key management and how hard it is to to invest in this asset class,” he said.

Anchorage caters specifically to institutional investors, with no plans to pursue retail customers, according to Mónica. He said the company doesn’t want to compete with Coinbase, Robinhood and all the other entities vying for individual investors.

Instead, Anchorage has formed partnerships with Visa, Silvergate Bank and BankProv on developing products and services.

“Our clients are very long-term thinkers,” he said. “They are not looking at the volatility and caring about it.”

HOME SWEET HOME

A $22.5 million sale of a Miami Beach penthouse is reportedly the largest real estate transaction paid for in crypto. The 5,067-square-foot luxury condo boasts ocean views as well as access to indoor and outdoor swimming pools, a rooftop tennis court, as well as a gym and yoga studio. Both the identity of the buyer as well as what type of crypto they used is unknown.

The pricey purchase brings up questions of the role crypto can play in real estate and whether brokerages will begin to seriously consider using it, especially for high-end transactions.

DEAL WATCH

- Flare Network recently raised $11.3 million from investors that include Kenetic Capital, Coinfund, Digital Currency Group and Litecoin founder Charlie Lee. The company looks to bring smart contract capability to blockchains like Dogecoin, Litecoin and XRP.

- Kenetic also led a $2.3 million seed funding round for startup Snickerdoodle Labs, which focuses on NFT data privacy. Other investors were Blockchain Capital, Struck Ventures, Zilliqa Capital as well as FTX and its CEO Sam Bankman-Fried.

WHAT WE’RE READING

- “One Crypto Exchange Is Going to Extreme Lengths on Cybersecurity” (Bloomberg)

- “Amid Crypto Price Mayhem, Elon Musk Doubles Down On Dogecoin” (Forbes)

- “Amazon Job Listing Seeks DeFi Experience” (Decrypt)

Hannah Miller is a reporter at The Information covering the crypto industry. She is based in San Francisco and can be found on Twitter at @hgmiller29.