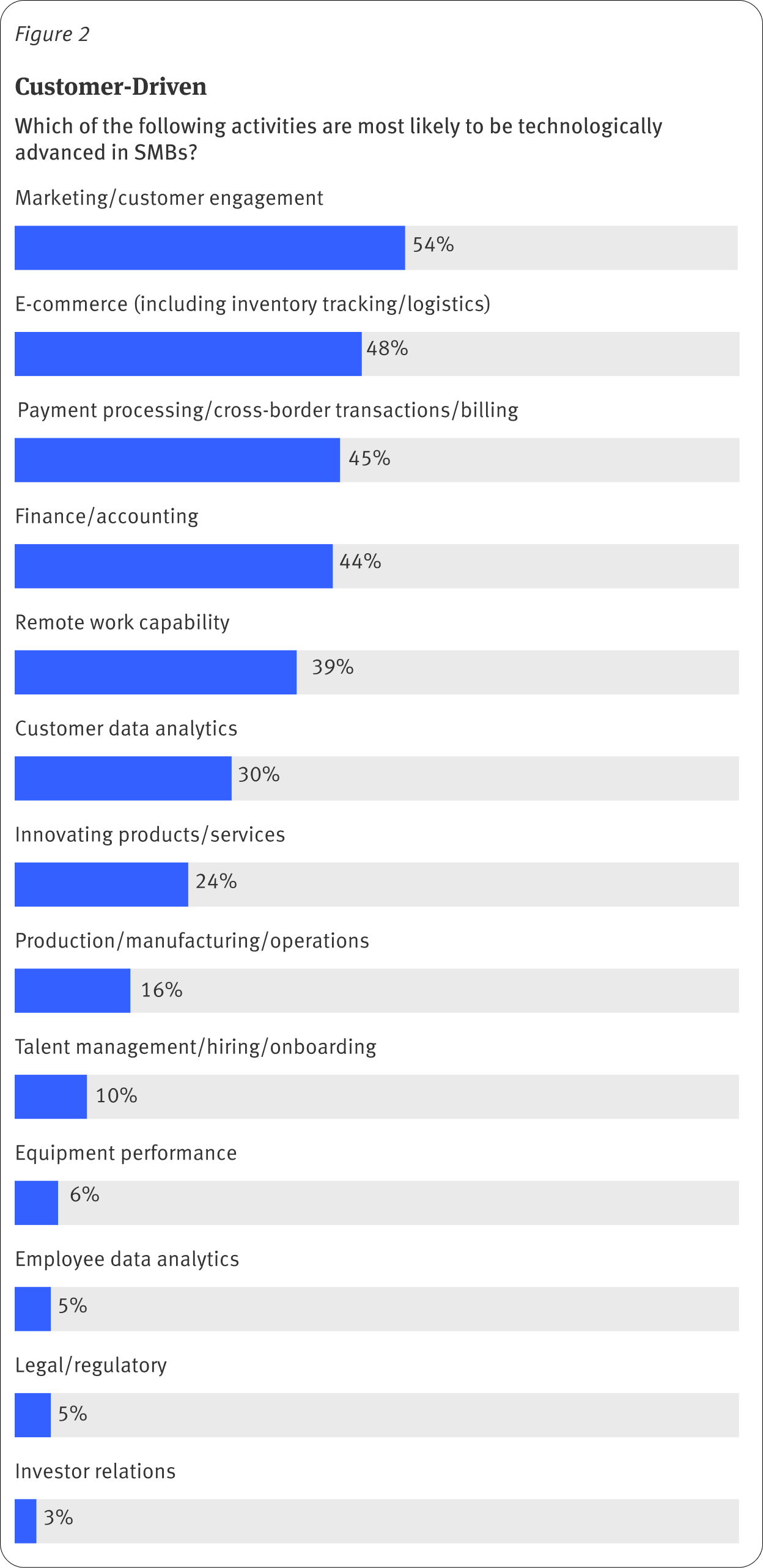

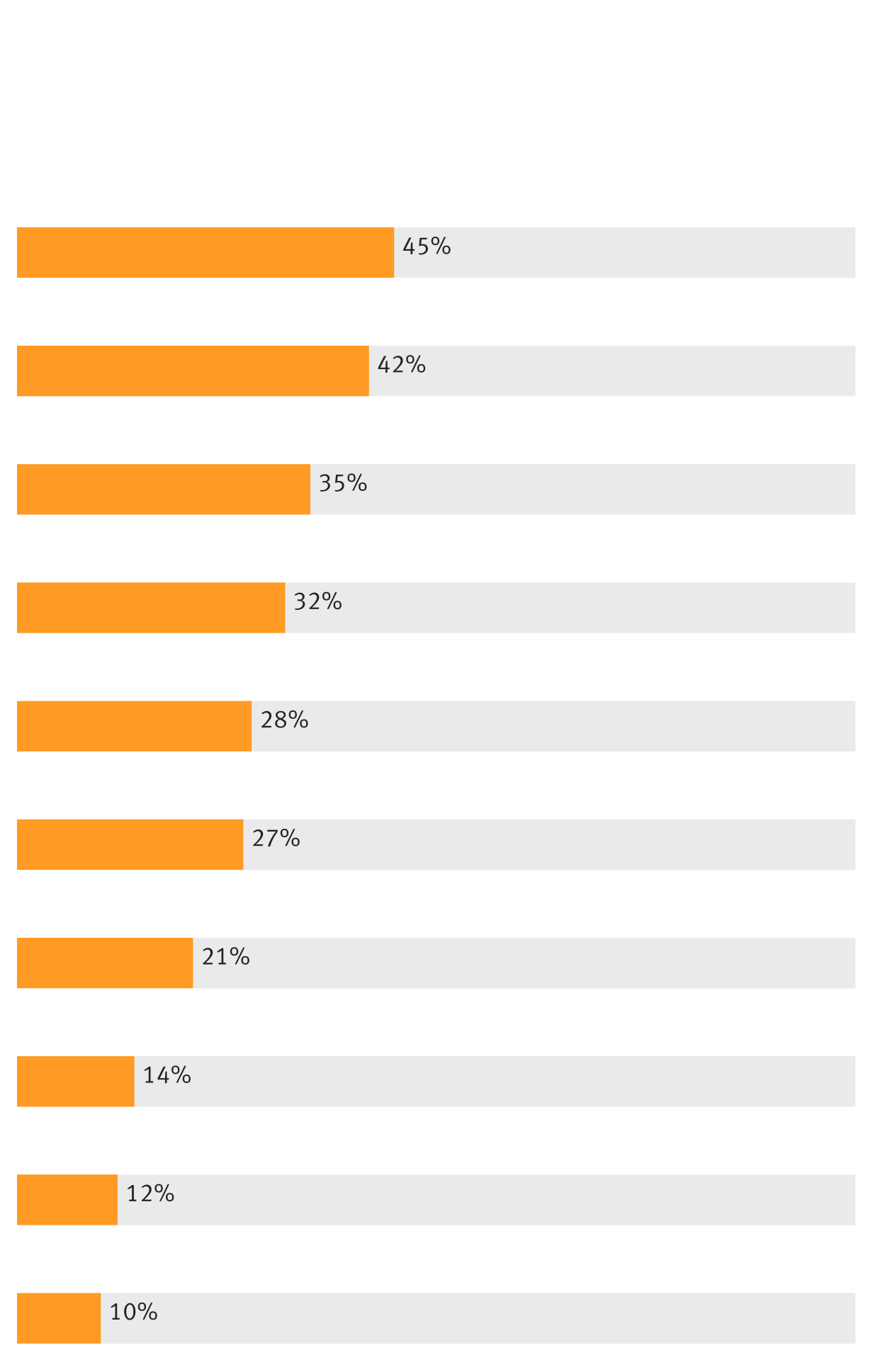

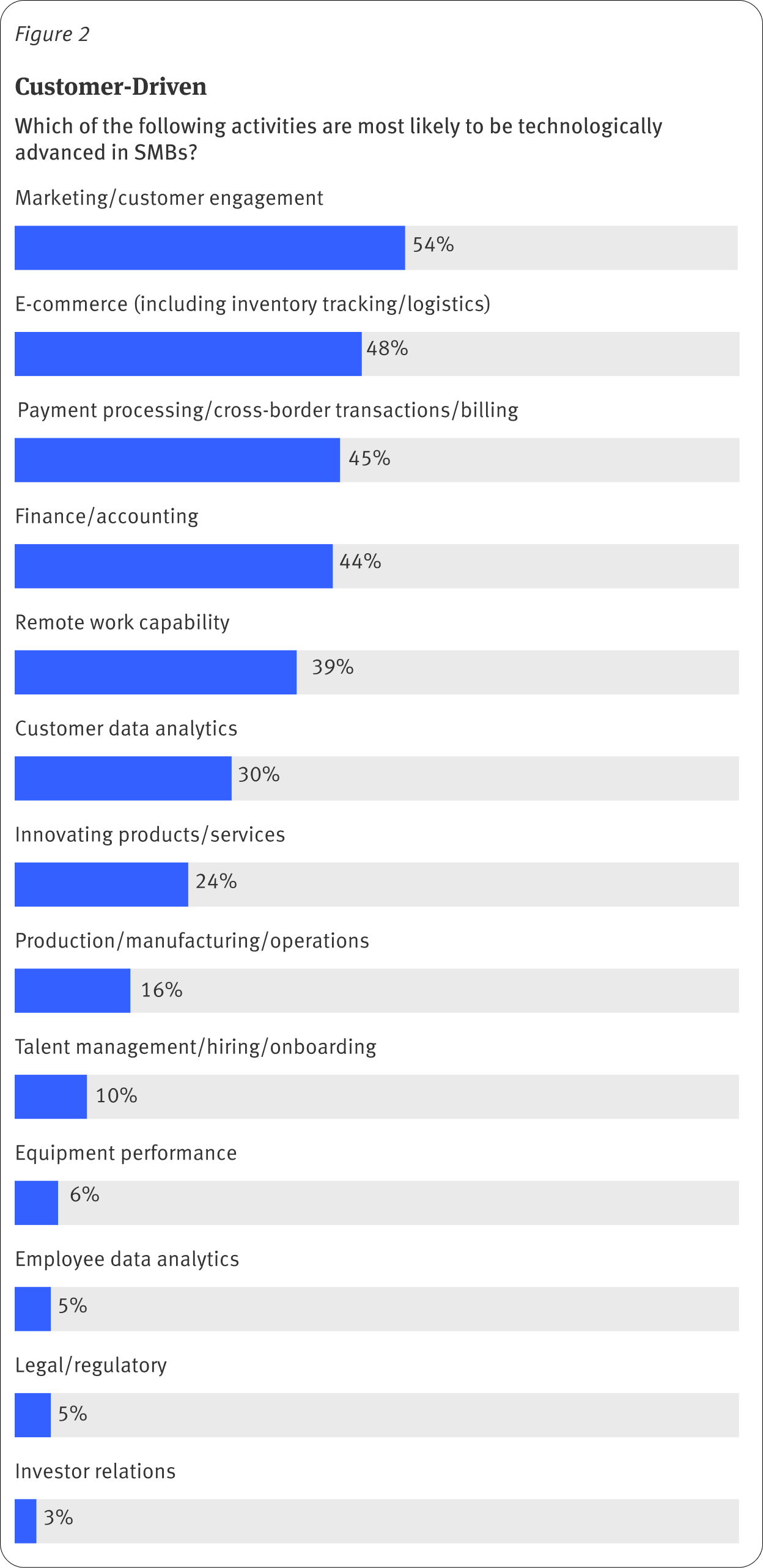

Marketing is the top area that is most likely to be technologically advanced in a

small business. “Unless you are an established business relaying on the same loyal

customer base, you need to be discoverable and findable to exist. You can achieve

that by having the right presence on marketing platforms or search engines, either

organic or paid,” says Engelberg.

Creating the right presence means being represented on the relevant touchpoints,

where the customers are most likely to find the business. That means striking the

right balance between concentrating on one big social outlet such as Facebook versus

trying to cover too many touchpoints and wasting time and advertising dollars on

channels that will not yield any new business. Also important is to keep up with the

most recent privacy developments and their impact on marketing efforts as well as

changing social media preferences and trends among the relevant customer segments.

Small businesses that rely on their gut feeling about what their customers want or

where they are risk building their futures on wrong assumptions. Considering that SMB

budgets, if they exist, are on the small side, having the right customer data is key

to understanding how best to allocate the money. Surprisingly, competence at customer

data analytics, which is necessary for success at digital marketing, is significantly

lower in the ranking of the areas that small businesses are technologically advanced

at, with less than a third (30%) of The Information’s survey respondents believing

that competence is adequate.

The good news is that data analytics ranks much higher (second) as a technology that

SMBs should be prioritizing (67%), and that it is considered the most important

application that SMBs need (55%), which points to an understanding of the importance

of data-driven decision making. Marketing measurement is one area where Palace Law is

continuing to look for new technology solutions. The firm tracks how their customers

learnt about them and which advertising channels were decisive for the client’s

hiring decision.

“We are working to improve the strategic use of technology in our marketing systems to invest the marketing budget in the best way possible,” says Couch.

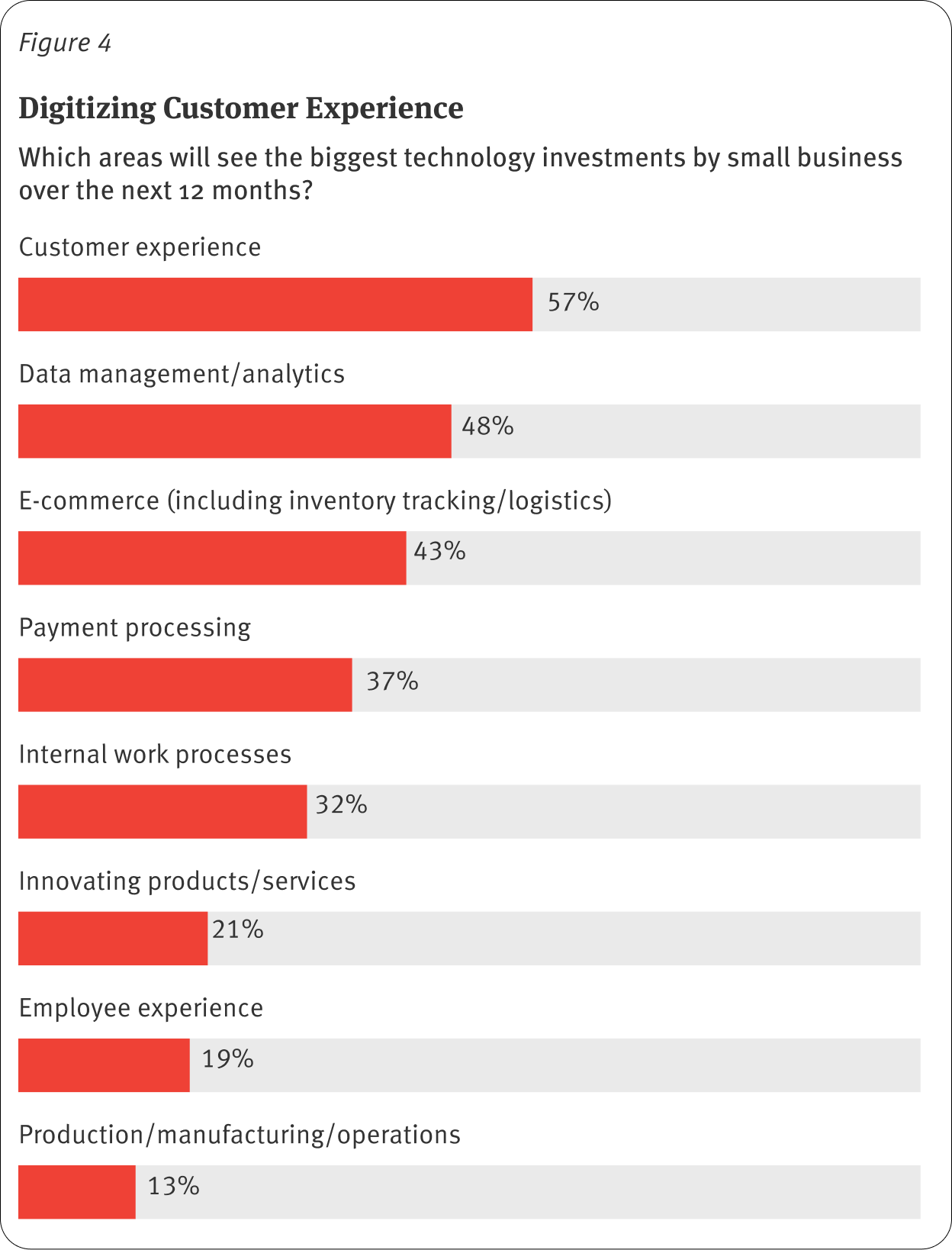

Payment software is the top technology that SMBs should have (68%). Payment software,

always crucial for the ability to close the deal, has been undergoing intense

innovation during the pandemic. This innovation includes contactless, cashier-less,

omni-channel and embedded payment solutions (e.g., Uber or Amazon Prime). The

adoption of digital payment methods has been spurred by customers who opted for

contactless payments during the pandemic.

Digital payments can have a big impact not only on closing customer transactions but

also on improving customer experience. For example, at Palace Law firm, improving the

payments experience for their clients involved creating an automatic email updating

system to let clients know when their settlement checks came in.

For Archie’s Reguero, making digital payments more efficient is a core business. He

considers payment processing part of the back-office operations that small businesses

need help with. Archie targets small businesses that rely on freelance work. Having a

technology solution to handle payments to contractors is cheaper than hiring people

to do that; also, being able to pay freelancers digitally and on time helps with

talent retention.

The Information’s survey rankings cast doubt on the ongoing discussion about how good

customer experience depends on good employee experience. The Information’s data shows

that SMBs are much more focused on technology relating to customers than to

employees. Just 5% believe that SMBs are likely to have technologically advanced

employee data analytics. Just 39% believe that remote working and collaboration are

technologically advanced. One bright data point for employee experience is that

project and task management tools are ranked as the most important technology

solution (55%). That means that SMBs recognize the importance of using technology to

create efficient work processes.

Employee experience has been gaining in importance in the era of The Great

Resignation, skills shortages and the ongoing kerfuffle about whether employees are

to return to the office or continue working mostly remotely. Further complicating the

talent landscape are high inflation, stock market volatility and fears of recession,

which are already causing some hiring freezes and layoffs, meaning that fewer people

will have to do more with less—an area ripe for technology solutions.

Employees at Palace Law can do much of their work from just about anywhere, being

able to access clients or draft and share documents on their mobile devices. Apart

from productivity, it improves the quality of life. For example, Couch has

participated in virtual court hearings with a judge while on his fishing boat.

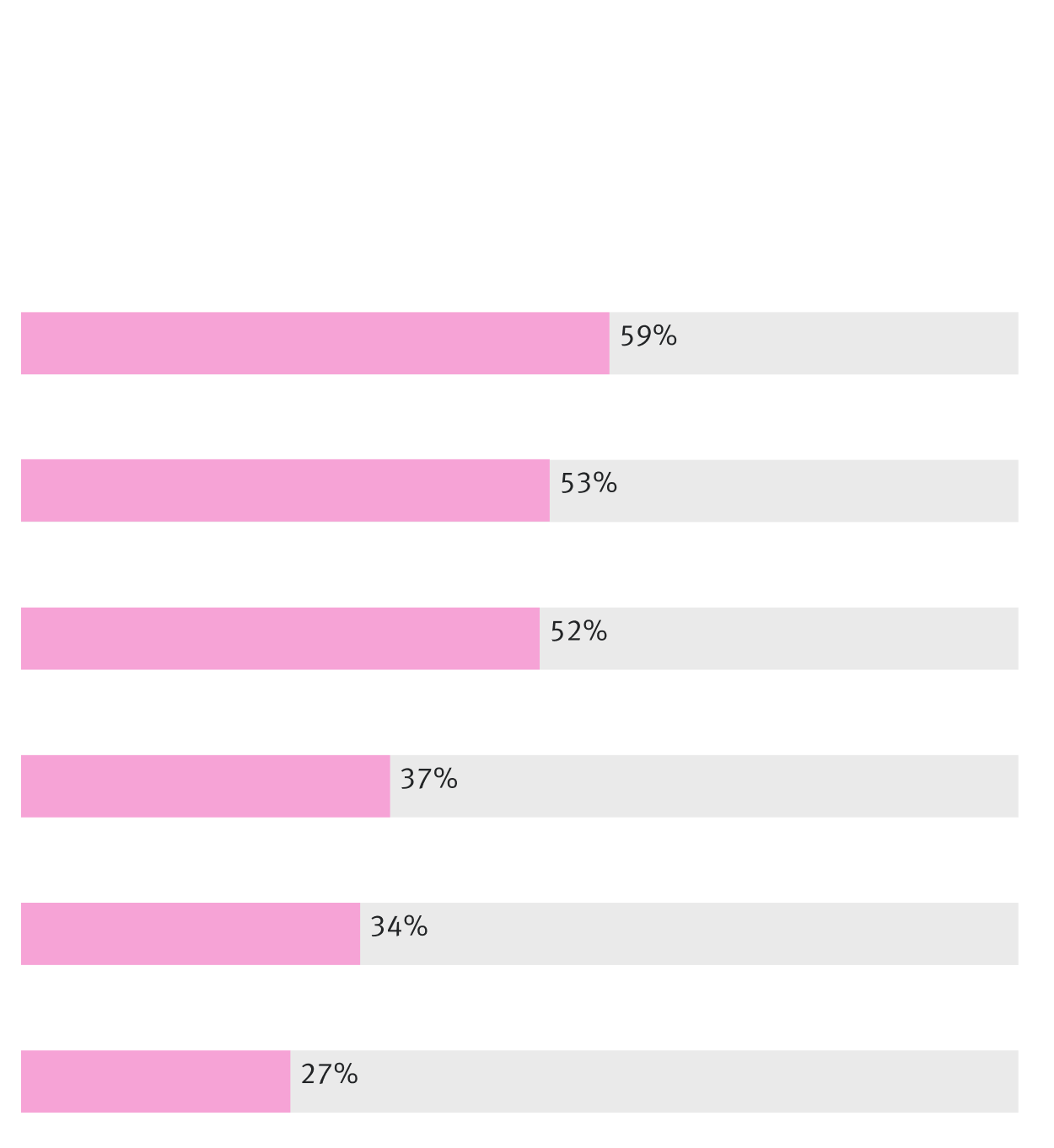

What SMBs prioritize is as telling as what they don’t prioritize. The latter includes

maintenance and security. Eighty percent of survey respondents believe that SMBs tend

to underestimate the importance of cybersecurity, 73% that they underestimate the

need to upgrade software, and 56% that SMBs typically underestimate the need to

upgrade hardware.

In this lack of attention to security and upgrades, SMBs are akin to politicians, who

are more likely to focus on building new bridges than repairing crumbling

infrastructure. But just as old bridges and roads can lead to grave consequences,

inattention to cybersecurity and software upgrades leads to breaches and crashes. And

that has grave consequences for business, as it translates directly into loss of

customer trust, brand reputation and ultimately, revenue.